Page 50 of 55

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Fri Sep 21, 2018 3:31 pm

by sorCrer

Patched and also in older versions anyway. Do you code?

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Fri Sep 21, 2018 3:36 pm

by sewa

sorCrer wrote:

Patched and also in older versions anyway. Do you code?

I don't code, we use outside consultants for that. It is the comments under this that are very worrying

Tweeted respected cryptocurrency expert and Cornell University professor, Emin Gün Sirer

Emin Gün Sirer

✔

@el33th4xor

· Sep 19, 2018

Major bug in Bitcoin Core, that can cause a total network fracture for BTC.

Empirically, bugs like this are found regularly in every coin. No implementation has been shown to be superior to others. All noise to the contrary is false marketing.

https://twitter.com/bitcoincoreorg/stat ... 2224860161 …

Looks like the bug fix made its way to Litecoin, but only after the BTC fix was announced. Does not look like Litecoin devs were notified of the bug prior to patch.

Copycat currencies are at risk. By definition, there's always a group upstream that knows their vulnerabilities.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Fri Sep 21, 2018 3:40 pm

by sorCrer

sewa wrote:sorCrer wrote:

Patched and also in older versions anyway. Do you code?

I don't code, we use outside consultants for that. It is the comments under this that are very worrying

Tweeted respected cryptocurrency expert and Cornell University professor, Emin Gün Sirer

Emin Gün Sirer

✔

@el33th4xor

· Sep 19, 2018

Major bug in Bitcoin Core, that can cause a total network fracture for BTC.

Empirically, bugs like this are found regularly in every coin. No implementation has been shown to be superior to others. All noise to the contrary is false marketing.

https://twitter.com/bitcoincoreorg/stat ... 2224860161 …

Looks like the bug fix made its way to Litecoin, but only after the BTC fix was announced. Does not look like Litecoin devs were notified of the bug prior to patch.

Copycat currencies are at risk. By definition, there's always a group upstream that knows their vulnerabilities.

Yeah. Look the Core code is open source. Anyone with sufficient knowledge can read it and look for holes. It's been around for coming on 10 years now. Holes get found and holes get closed. This is good. Bugs happen in software.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Fri Sep 21, 2018 3:46 pm

by sewa

sorCrer wrote:

Yeah. Look the Core code is open source. Anyone with sufficient knowledge can read it and look for holes. It's been around for coming on 10 years now. Holes get found and holes get closed. This is good. Bugs happen in software.

Eh, no its not good. Certainly not if you get up one morning and all your cash is gone. The worrying thing from a compliance perspective is having identified the weakness the why did the developers not inform the litecoin developers in a timely fashion? You have to build trust in your product and this does not help at all

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Fri Sep 21, 2018 3:51 pm

by sorCrer

sewa wrote:sorCrer wrote:

Yeah. Look the Core code is open source. Anyone with sufficient knowledge can read it and look for holes. It's been around for coming on 10 years now. Holes get found and holes get closed. This is good. Bugs happen in software.

Eh, no its not good. Certainly not if you get up one morning and all your cash is gone. The worrying thing from a compliance perspective is having identified the weakness the why did the developers not inform the litecoin developers in a timely fashion? You have to build trust in your product and this does not help at all

You shouldn't have all your cash invested in BTC. I agree that it's not ideal. Software writing is difficult. I hadn't heard of this Litecoin angle before although I knew about the flaw. I'd agree that devs should notify other devs using a common codebase if there is a flaw. As you well know, in the majority of cases flaws are actually quite difficult to exploit in the real world.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Fri Sep 21, 2018 6:48 pm

by Anonymous 1

sorCrer wrote:sewa wrote:sorCrer wrote:

Patched and also in older versions anyway. Do you code?

I don't code, we use outside consultants for that. It is the comments under this that are very worrying

Tweeted respected cryptocurrency expert and Cornell University professor, Emin Gün Sirer

Emin Gün Sirer

✔

@el33th4xor

· Sep 19, 2018

Major bug in Bitcoin Core, that can cause a total network fracture for BTC.

Empirically, bugs like this are found regularly in every coin. No implementation has been shown to be superior to others. All noise to the contrary is false marketing.

https://twitter.com/bitcoincoreorg/stat ... 2224860161 …

Looks like the bug fix made its way to Litecoin, but only after the BTC fix was announced. Does not look like Litecoin devs were notified of the bug prior to patch.

Copycat currencies are at risk. By definition, there's always a group upstream that knows their vulnerabilities.

Yeah. Look the Core code is open source. Anyone with sufficient knowledge can read it and look for holes. It's been around for coming on 10 years now. Holes get found and holes get closed. This is good. Bugs happen in software.

I have very little knowledge of softy but I nearly LOL when I read "this is good"

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Fri Sep 21, 2018 7:26 pm

by derriz

sorCrer wrote:derriz wrote:goeagles wrote:The intention of the graph in this context is to show that Bitcoin has faced multiple drops, on a percentage basis, greater than this supposed all time worst crash. Because of that, log scale is absolutely appropriate. I don't really care whether or not you think the graph is misleading in some other context.

Except the price graph does a terrible job as humans do not naturally perceive percentage drops on log scales. Creativity with price graphs - stretching the scales, sliding the scales, using log scales has been the mark of the financial charletanism for a century at least.

goeagles wrote:And Bitcoin isn't particularly risky when a small part (say 1%) of a larger portfolio because it is much less correlated with the market than other assets (although increasingly less so). Let's take 2 portfolios. Option A is 60% equities and 40% bonds. Option B is 60% equities, 39% bonds and 1% Bitcoin. Which do you think would have had greater volatility over the last year?

This makes no sense. Playing roulette - as long as it's only with 1% of your portfolio - will not greatly affect the overall volatility of the portfolio either.

And the less correlated aspect is useless to an investor if the expected return is negative.

And I'd be very surprised if the daily volatility of the Option B was lower. But feel free to show me the numbers: overall sharpes and the daily return coorelation matrix for the 3 asset classes. Although since you are talking about only 1% allocated to bitcoin, the differences of course will be minscule.

goeagles wrote:Edit to add that Bitcoin, like gold, is also a hedge against tail risk and that any discussion of how risky it is is incomplete without that.

How is it a hedge against tail risk? Gold has 1000s of years of documented history as a hedge against calamity - what pedigree has bitcoin got? It didn't even exist before the GFC and its price bubble coincided with one periods of huge price inflation across multiple asset classes.

The closest time we have to be able to test it would be the period from mid-late 2011 to about a year later when equity volatility spiked and gold soared. Unlike gold, bitcoin shed half it's value.

The bitcoin boosters are always moving the goalposts; first it was going to revolutionize payments, until it turned out that it was sh1t for payments. Then it was going to free us from the tyranny of "the man" until China dominated mining - meaning the network could be fücked anytime the freedom loving Chinese govenment decided. Then it was going to act as a long term store of value, until it turned out to be sh1t for that too with 50% drawdowns occurring on a regular basis. Next it's a "haven" asset that people will rush to in times of crisis except the only time in its tiny history where we had a significant risk-off period, it shed value.

But I don't know why I bother with this stuff - it's hard to know whether I'm talking with someone who is sipping the coolaid or someone who is pressing the bottles into people's hands. Honestly, if you weren't an investor in BTC, would you be spending time defending it? It's absolutely worthless from every perspective - even the technology (cryptographic distributed ledger) is a curiosity and nothing more.

Your view on Ripple?

No strong opinion because I don't know much about it. Do you mean as a technology/platform or the coin?

I think all the current coins are worthless. It costs zero to create them and they deliver no or very little utility. The prices are sustained purely by hype and bullshit.

I used to think the tech was interesting and that there must be novel applications waiting to be discovered but even there I'm skeptical. I don't expect any interesting applications to emerge in the near future. All businesses/companies want to be able to use legal systems to correct mistakes - hard cryptography is simply not an attractive tool in such a world. PKI is an idea that's great in theory but has achieved fudge all traction despite it being around for decades. It's 10 times easier to just roll-out a serverless architecture on the cloud than try to deploy an application built on a distributed ledger.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Tue Oct 02, 2018 6:57 pm

by sorCrer

Lightning network grown another 10% this month with capacity up 15% to around 110 BTC.

Interesting video released this weekend paying for a Coke with a QR Code and Lightning Network.

https://www.youtube.com/watch?v=2Fb6Xww2P7c

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Oct 03, 2018 4:26 am

by kiwinoz

Isnt Litecoin the best for maximising the Lightning Network?

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Oct 03, 2018 4:57 am

by Anonymous 1

It's all a steaming pile of excrement

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Tue Nov 20, 2018 12:54 pm

by sewa

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Tue Nov 20, 2018 3:59 pm

by sewa

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Tue Nov 20, 2018 4:07 pm

by Anonymous 1

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Tue Nov 20, 2018 11:07 pm

by paddyor

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Thu Nov 22, 2018 12:12 am

by Floppykid

So, is democracy saved yet?

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Mon Nov 26, 2018 10:47 pm

by derriz

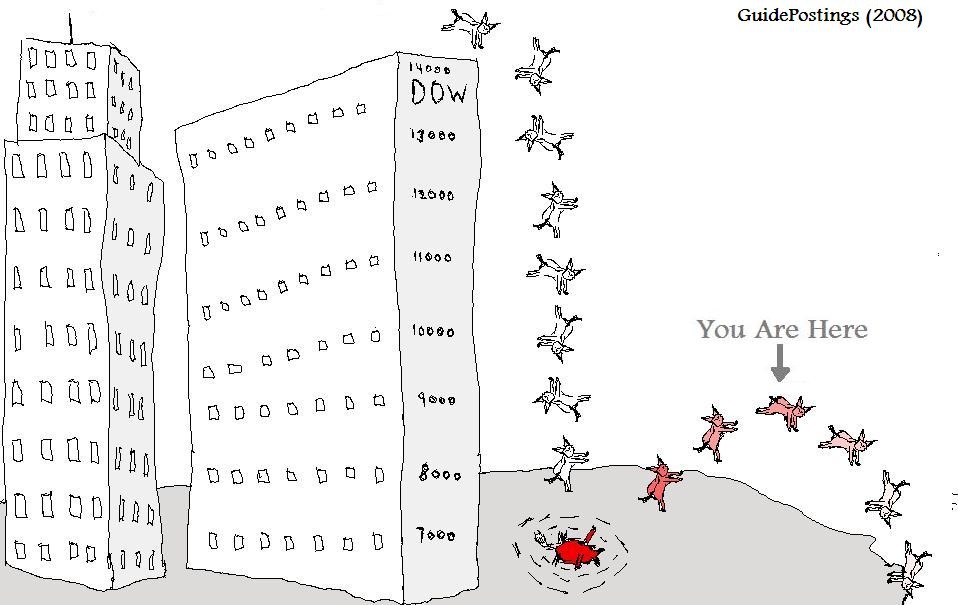

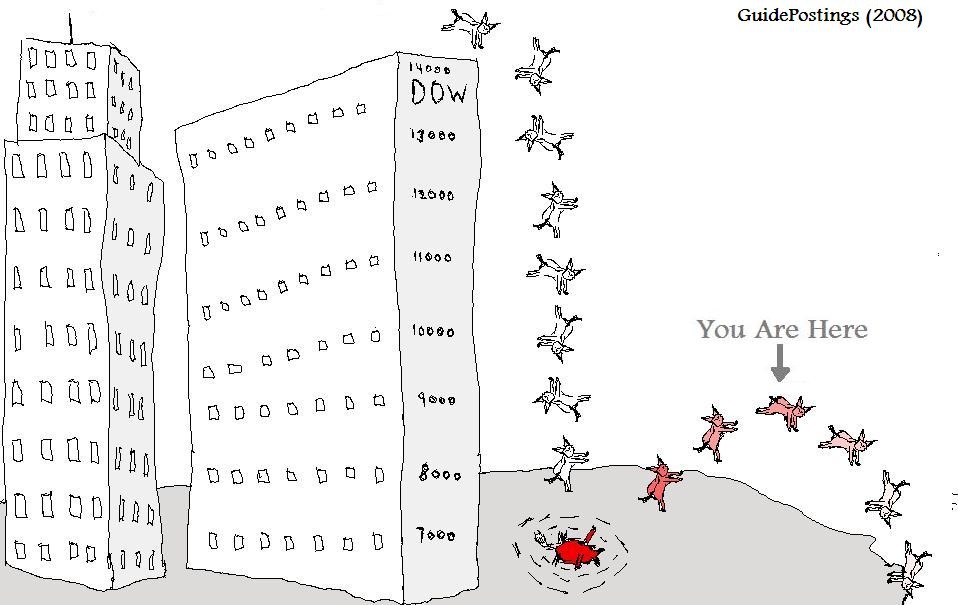

Surely this thread deserves a bounce? Bitcoin has lost nearly half it's value since goeagles presented that comforting graph. And the other coins (which you were supposed to buy for "diversification") have done even worse.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Tue Nov 27, 2018 2:52 am

by merlin the happy pig

But I thought it was supposed to be a currency, not an investment?

I must have missed something

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:57 am

by Anonymous 1

goeagles wrote:Edit to add that Bitcoin, like gold, is also a hedge against tail risk and that any discussion of how risky it is is incomplete without that.

Bitcoin is bouncing it's way down nicely

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 3:47 am

by Anonymous 1

derriz wrote:goeagles wrote:

It's not even Bitcoin's worst % loss in the last 5 years.

That's a very deceptive graph.

Using a log price scale makes it look like an investor at the peak has only suffered minor losses.

The true scale of fall since the peak are clear when you scale the price linearly:

lost more than half it's "value" again since your post.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 7:16 am

by waguser

Anonymous. wrote:

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 7:42 am

by sorCrer

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 11:02 am

by derriz

For me this is represents all that's wrong with the crypto technology research. Someone has managed to come up with a complicated, slow, expensive and non-general mechanism to do a limited form of 2 phase commit and this achievement gets hyped as a breakthrough.

Meanwhile "traditional" unhyped technologies (databases, message queues, app servers, CICS, etc.) have been able to support fully general distributed transactions across products from different vendors using 2-phase commit for decades (e.g. X/Open XA is nearly 30 years). Distributed transactions are trivial (outside of the blockchain hype-bubble) and are not even considered a problem.

This "breakthrough" demonstrates that trying to build applications on this technology (blockchain) makes trivial tasks incredibly complex and difficult. Outside of some tiny tiny niches, you'd be mad to consider building any application on blockchain.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 11:06 am

by sewa

I am sure that is great consolation to the likes of Trancenrg who was busy buying shitloads of bitcoin at 20k and now finds them worth 3.3k

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 12:08 pm

by A5D5E5

That article highlights the problem crypto currencies have if they are ever to really become mainstream. I am reasonably smart, fairly tech savvy and have free cash that is always looking for a home.

Yet I read that article and I get exactly the same impression I get when I read any article about crypto currencies - it is written for the benefit of the "insiders", not the general population. It is dripping with jargon and techno babble and should scare off anyone who is not immersed in the technology every day.

To really become mainstream, crypto currencies need to be communicated in a different way.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 12:56 pm

by jezzer

derriz wrote:

For me this is represents all that's wrong with the crypto technology research. Someone has managed to come up with a complicated, slow, expensive and non-general mechanism to do a limited form of 2 phase commit and this achievement gets hyped as a breakthrough.

Meanwhile "traditional" unhyped technologies (databases, message queues, app servers, CICS, etc.) have been able to support fully general distributed transactions across products from different vendors using 2-phase commit for decades (e.g. X/Open XA is nearly 30 years). Distributed transactions are trivial (outside of the blockchain hype-bubble) and are not even considered a problem.

This "breakthrough" demonstrates that trying to build applications on this technology (blockchain) makes trivial tasks incredibly complex and difficult. Outside of some tiny tiny niches, you'd be mad to consider building any application on blockchain.

Not only that, but aren't blockchain resolutions INCREDIBLY energy-inefficient? I'm wary of reports and studies that try to estimate the energy consumed for blockchain activities such as mining Bitcoin, but it's clear we are talking about Gigawatts. This is "hidden" in the decentralised structure of blockchain, but the consumption is very much a reality.

Once blockchain were to expand to provide whatever solutions the world deemed necessary (2-phase commit, proof of work, replacement of tangible currencies) wouldn't the required energy consumption by miners/peers/whatever they end up being called cripple the combined global energy generation networks?

Blockchain appears to run counter to the global trend of energy-efficiency and appears to be an onerously expensive methodology for society.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 1:14 pm

by A5D5E5

Seneca of the Night wrote:A5D5E5 wrote:

That article highlights the problem crypto currencies have if they are ever to really become mainstream. I am reasonably smart, fairly tech savvy and have free cash that is always looking for a home.

Yet I read that article and I get exactly the same impression I get when I read any article about crypto currencies - it is written for the benefit of the "insiders", not the general population. It is dripping with jargon and techno babble and should scare off anyone who is not immersed in the technology every day.

To really become mainstream, crypto currencies need to be communicated in a different way.

Atomic swap is pretty catchy.

Meh. Atomic is so 19th century. The cool kids are into supersymmetric particles now. I'd go for "Quantum squark exchange".

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:06 pm

by sorCrer

jezzer wrote:derriz wrote:

For me this is represents all that's wrong with the crypto technology research. Someone has managed to come up with a complicated, slow, expensive and non-general mechanism to do a limited form of 2 phase commit and this achievement gets hyped as a breakthrough.

Meanwhile "traditional" unhyped technologies (databases, message queues, app servers, CICS, etc.) have been able to support fully general distributed transactions across products from different vendors using 2-phase commit for decades (e.g. X/Open XA is nearly 30 years). Distributed transactions are trivial (outside of the blockchain hype-bubble) and are not even considered a problem.

This "breakthrough" demonstrates that trying to build applications on this technology (blockchain) makes trivial tasks incredibly complex and difficult. Outside of some tiny tiny niches, you'd be mad to consider building any application on blockchain.

Not only that, but aren't blockchain resolutions INCREDIBLY energy-inefficient? I'm wary of reports and studies that try to estimate the energy consumed for blockchain activities such as mining Bitcoin, but it's clear we are talking about Gigawatts. This is "hidden" in the decentralised structure of blockchain, but the consumption is very much a reality.

Once blockchain were to expand to provide whatever solutions the world deemed necessary (2-phase commit, proof of work, replacement of tangible currencies) wouldn't the required energy consumption by miners/peers/whatever they end up being called cripple the combined global energy generation networks?

Blockchain appears to run counter to the global trend of energy-efficiency and appears to be an onerously expensive methodology for society.

Lightning Network (allowing for off chain transactions) was invented to mitigate the energy consumption. But you are correct proof of work transactional verification is not as energy efficient as proof of stake due to its competitive and lottery like mechanism.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:06 pm

by Anonymous 1

sewa wrote:

I am sure that is great consolation to the likes of Trancenrg who was busy buying shitloads of bitcoin at 20k and now finds them worth 3.3k

In it for the tech

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:07 pm

by sewa

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:22 pm

by sorCrer

derriz wrote:Meanwhile "traditional" unhyped technologies (databases, message queues, app servers, CICS, etc.) have been able to support fully general distributed transactions across products from different vendors using 2-phase commit for decades (e.g. X/Open XA is nearly 30 years). Distributed transactions are trivial (outside of the blockchain hype-bubble) and are not even considered a problem.

This "breakthrough" demonstrates that trying to build applications on this technology (blockchain) makes trivial tasks incredibly complex and difficult. Outside of some tiny tiny niches, you'd be mad to consider building any application on blockchain.

Sure, but none of them are decentralized or in a technical sense immutable. That said, existing technologies work perfectly well as they always have. Applications that would work well on a blockchain are potential things like genealogy tracking or traceability of parts, origin, public sector records etc.

I presume you're excluding smart contracts (and computing) on Turing-complete Ethereum and focusing mostly on the Bitcoin Blockchain.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:25 pm

by sorCrer

sewa wrote:

I am sure that is great consolation to the likes of Trancenrg who was busy buying shitloads of bitcoin at 20k and now finds them worth 3.3k

I don't think he was buying them at $20k but if it's any consolation I hold quite a few and I don't think that they will ever go to 20k in the near to medium term.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:27 pm

by sorCrer

sorCrer wrote:Lightning network grown another 10% this month with capacity up 15% to around 110 BTC.

Interesting video released this weekend paying for a Coke with a QR Code and Lightning Network.

https://www.youtube.com/watch?v=2Fb6Xww2P7c

Now 4500 nodes with 488BTC

https://1ml.com/statistics

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:33 pm

by sewa

sorCrer wrote:sewa wrote:

I am sure that is great consolation to the likes of Trancenrg who was busy buying shitloads of bitcoin at 20k and now finds them worth 3.3k

I don't think he was buying them at $20k but if it's any consolation I hold quite a few and I don't think that they will ever go to 20k in the near to medium term.

If you look at the dates on his posts they were very high when he was getting in. What wonderful technology, it turned his retirement house into a bedsit

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:45 pm

by derriz

jezzer wrote:derriz wrote:

For me this is represents all that's wrong with the crypto technology research. Someone has managed to come up with a complicated, slow, expensive and non-general mechanism to do a limited form of 2 phase commit and this achievement gets hyped as a breakthrough.

Meanwhile "traditional" unhyped technologies (databases, message queues, app servers, CICS, etc.) have been able to support fully general distributed transactions across products from different vendors using 2-phase commit for decades (e.g. X/Open XA is nearly 30 years). Distributed transactions are trivial (outside of the blockchain hype-bubble) and are not even considered a problem.

This "breakthrough" demonstrates that trying to build applications on this technology (blockchain) makes trivial tasks incredibly complex and difficult. Outside of some tiny tiny niches, you'd be mad to consider building any application on blockchain.

Not only that, but aren't blockchain resolutions INCREDIBLY energy-inefficient? I'm wary of reports and studies that try to estimate the energy consumed for blockchain activities such as mining Bitcoin, but it's clear we are talking about Gigawatts. This is "hidden" in the decentralised structure of blockchain, but the consumption is very much a reality.

Once blockchain were to expand to provide whatever solutions the world deemed necessary (2-phase commit, proof of work, replacement of tangible currencies) wouldn't the required energy consumption by miners/peers/whatever they end up being called cripple the combined global energy generation networks?

Blockchain appears to run counter to the global trend of energy-efficiency and appears to be an onerously expensive methodology for society.

Yeah and the current "solution" for public ledgers is to effectively delegate the processing to an external authority. Huge effort has gone into non-proof-of-work consensus - the Etherium people have been promising something for years - and as of yet nothing credible has been deployed.

The enterprise blockchain people (Corda, Hyperledger, etc.) have basically dropped the consensus part for this very reason so you end up with all the complexity of running a proof-of-work blockchain except it relies on a centralized trusted node to resolve ledger ordering.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 2:56 pm

by sorCrer

sewa wrote:What wonderful technology, it turned his retirement house into a bedsit

Noting the the 'technology' didn't do anything to Trances money, anyone investing money they couldn't afford to lose in any technology or even stock deserves to lose it.

Did you also lose money you couldn't afford to? Is that why you're so bitter?

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 3:00 pm

by sewa

sorCrer wrote:sewa wrote:What wonderful technology, it turned his retirement house into a bedsit

Noting the the 'technology' didn't do anything to Trances money, anyone investing money they couldn't afford to lose in any technology or even stock deserves to lose it.

Did you also lose money you couldn't afford to? Is that why you're so bitter?

I am a no coiner. My explanation for why can be found on page one of this thread and still remains just as valid today

(I did almost buy some though just for a laugh)

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 3:02 pm

by sorCrer

sewa wrote:Is the point of a currency not that you can use it to buy things. If people are just holding it then it is no more than a pyramid scheme

I'm presuming this one. Fair enough.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 3:06 pm

by derriz

sorCrer wrote:derriz wrote:Meanwhile "traditional" unhyped technologies (databases, message queues, app servers, CICS, etc.) have been able to support fully general distributed transactions across products from different vendors using 2-phase commit for decades (e.g. X/Open XA is nearly 30 years). Distributed transactions are trivial (outside of the blockchain hype-bubble) and are not even considered a problem.

This "breakthrough" demonstrates that trying to build applications on this technology (blockchain) makes trivial tasks incredibly complex and difficult. Outside of some tiny tiny niches, you'd be mad to consider building any application on blockchain.

Sure, but none of them are decentralized or in a technical sense immutable. That said, existing technologies work perfectly well as they always have. Applications that would work well on a blockchain are potential things like genealogy tracking or traceability of parts, origin, public sector records etc.

I presume you're excluding smart contracts (and computing) on Turing-complete Ethereum and focusing mostly on the Bitcoin Blockchain.

Who cares? It's trivial to make a database table immutable even if you want it done with hard cryptographic guarantees. De-centralization offers no tangible benefits - high availability/fault tolerance/redundancy/replication/etc. with traditional IT technologies is also a solved problem - using serverless or cloud more-or-less gives it to you for free. Blockchain with or without smart contracts is a technology solution looking for a problem. It's been promising all sorts of cool applications for years and billions of VC and foolish ICO participants' money has been wasted on the pursuit yet it has delivered absolutely nothing except silly "demos" to other blockchainistas.

Could you name an actual existing widely-used application which demonstrates the utility of blockchain rather than hypothetical examples? Because I can't find a single useful application - the most promising (I used to think) IPFS is going nowhere.

All your examples, simply require simple cryptographic signatures not blockchain/smart contracts; anyone can cryptographically sign anything with a single command using openssl/libressl/whatever. Again a solved problem.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Wed Dec 19, 2018 3:15 pm

by brero

sorCrer wrote:Applications that would work well on a blockchain are potential things like ... traceability of parts

how would that work? i've seen this mentioned quite a bit as a potential application but haven't seen anything beyond vague marketing.

Re: €100 of Bitcoin in 2010 = €70m today

Posted: Sun Dec 23, 2018 8:08 pm

by Anonymous 1

sorCrer wrote:sewa wrote:What wonderful technology, it turned his retirement house into a bedsit

Noting the the 'technology' didn't do anything to Trances money,

anyone investing money they couldn't afford to lose in any technology or even stock deserves to lose it.

Did you also lose money you couldn't afford to? Is that why you're so bitter?

So people whose pension money is invested in stocks deserve to lose it if they can't afford to lose their pensions